|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Chapter 7 Bankruptcy California Exemptions: Understanding Your Options

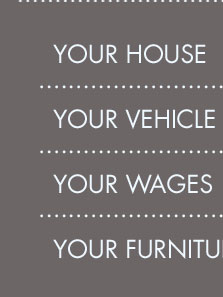

Filing for Chapter 7 bankruptcy in California can be a daunting process. However, understanding the exemptions available to you can significantly ease the stress. These exemptions allow you to keep certain property, providing a fresh start post-bankruptcy.

What Are Bankruptcy Exemptions?

Bankruptcy exemptions are laws that protect specific types of property from being used to pay creditors during a bankruptcy case. In California, there are two sets of exemptions to choose from: the state exemptions and the federal nonbankruptcy exemptions.

California State Exemptions

- Homestead Exemption: Protects equity in your home up to a certain amount, which can vary depending on specific circumstances.

- Personal Property: Includes household items, clothing, and other personal effects up to a certain value.

- Vehicle Exemption: Allows you to exempt equity in a motor vehicle up to a specified limit.

Federal Nonbankruptcy Exemptions

These exemptions are not typically used in California, as most residents opt for the state exemptions. However, they may protect retirement accounts, disability benefits, and other specific assets.

Choosing Between Exemption Systems

Choosing the right set of exemptions is crucial. For instance, if you have a significant amount of home equity, the California state exemptions might be more beneficial. In contrast, those with substantial personal property might consider the federal exemptions. It's important to weigh these options carefully or consult with a professional to decide.

Commonly Asked Questions

When considering Chapter 7 bankruptcy, many people have similar concerns and questions. Understanding these can help clarify the process.

Can I keep my car if I file for Chapter 7 in California?

Yes, you can keep your car if its equity is within the state exemption limit. If the equity exceeds the limit, you may need to pay the difference or negotiate with the trustee.

What happens to my house in Chapter 7 bankruptcy?

Your house can be exempted up to a certain amount of equity through the homestead exemption. If your equity is higher than the exemption, you might have to consider alternative options, such as a repayment plan, similar to those found in chapter 13 bankruptcy ky.

How often can I file for Chapter 7 bankruptcy?

You can file for Chapter 7 bankruptcy every eight years from the date of your last filing. This ensures you have time to rebuild financially between filings.

Is Chapter 7 bankruptcy better than Chapter 13?

It depends on your financial situation. Chapter 7 is faster and eliminates unsecured debt, while Chapter 13, such as chapter 13 bankruptcy mn, allows you to keep more property through a repayment plan. Consulting with a bankruptcy attorney can help determine the best option for you.

7. LIFE INSURANCE C.C.P. 703.140(b)(8). An exemption is allowed in any ...

In System 1 (also known as 704 exemptions), you can exempt real or personal property you reside in at the time of filing for bankruptcy, including a mobile ...

California Bankruptcy Exemptions ; Jewelry, heirlooms and art to $5000 total (husband and wife may not double). 704.040 ; Motor vehicles to $1900, or $1900 in ...

![]()